Crypto News Round-Up From Around the World

The world of Bitcoin, blockchain and cryptocurrencies is one that never stops moving. Despite the recent slump, the industry is on the up, and there’s a lot to delve into this week.

Take a look at the most recent crypto news you need to know from all around the world.

Binance Issues Crypto Card to Aid Ukranian Refugees

In a truly remarkable gesture of goodwill and humanitarian aid, Binance launched the Binance Refugee Crypto Card earlier this year. The card aimed to make it easier for refugees from the Ukraine who had been displaced across Europe due to the war to receive financial support and buy the goods and services they desperately needed.

Helen Hai, Head of Binance Charity, said:

“We want to see blockchain working for people, solving real-world problems and using it as a tool to connect those who want to help, directly with those in need of it.”

To support the aid initiative, they also launched the cryptocurrency crowdfunding site “Emergency Assistance Fund for Ukraine” which allowed good Samaritans to donate crypto, which could then be distributed via the Refugee Crypto Card.

According to a report by Bitcoin.com, more than 70,000 cards have been issued to refugees who would ordinarily have had no access to funds once they arrived in Europe. Binance extended the scope of the card, which was meant to focus on the EU, by issuing nearly 2000 cards to refugees outside of Europe.

They are also working with the Ukrainian Ministry of Digital Development to develop online learning courses to create employment opportunities for jobless Ukrainians.

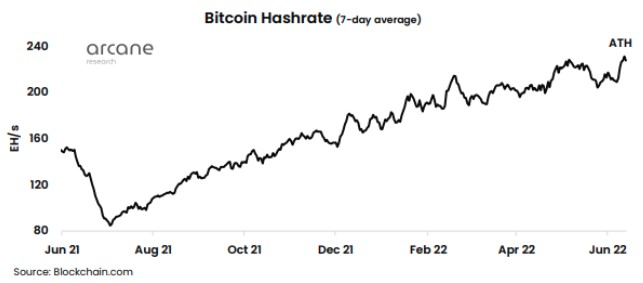

Bitcoin Hashrate Skyrockets Despite Price Slump

When any asset loses value, some tuck tail and run and those who stand by their belief in the product. With the Bitcoin price dropping nearly 30% in the past week, its hashrate has increased significantly speaks volumes of the place it has carved for itself in the digital economic landscape.

The higher a cryptocurrency’s hashrate, the more rigs are actively mining the token. According to Arcane Research, the response to Bitcoin’s decline in value has been a steady increase in mining activity, with the last 7-day average particularly bullish.

The report addresses the fact that more active rigs mean a drop in value for work done as the fixed rewards are now shared among a larger pool of miners. However, the more important note is that rather than jumping ship for Bitcoin competitors, these miners are doubling down on the coin in anticipation of its inevitable resurgence.

Crypto Gambling Defies The Odds With Upward Trend

With Bitcoin dropping below $22,000 this month, continuing its seven-month slump, and the crypto market overall losing another $400 billion, it has been encouraging to see that the crypto gambling is holding firm.

According to a report by GamblingInsider, there has been an increase in online casinos that now offer deposits and withdrawals via Bitcoin, Ethereum, Dogecoin and other digital tokens.

Not only are existing brands offering gambling tokens, but there is an increase in the number of dedicated crypto-casinos. These sites are built on the blockchain, offer provably fair gaming and provide far greater security than traditional casino sites.

SNACK Token Takes The Online Gambling Market By Storm

There is no greater proof of an industry’s willingness to adopt new technology than when market segments begin to specialise. Thanks to the meteoric growth of Bitcoin, it could grab mainstream media attention and pave the way for future digital coins that could be less investment-focused and instead offer practical daily-use tokens.

SNACK is the industry’s first specialised-iGaming DEX token. SNACK launched on the Binance Smart Chain early in 2022 and has already partnered with more than 300 online casinos and betting sites.

The community-drive DeFi token also takes its responsibility to mother nature very seriously. Under the banner of Green SNACK, 10% of all Crypto Snacks Tokens support green initiatives worldwide.

If you’re looking for a specialist iGaming token with a vision for a healthier planet, SNACK should be on your radar.

Bank of Canada Leadership Call For Regulation to Streamline Crypto Adoption

When considering large corporations’ and governments’ actions and announcements, it is essential to read between the lines to discern their true intent. In a recent interview with Reuters, Bank of Canada’s Senior Deputy Governor Carolyn Rogers addressed the need for crypto regulation in the country.

Rogers shared that with the global growth of cryptocurrency, they have seen the number of Canadians who own digital tokens increase yearly. In 2020 only 5% of locals dabbled in virtual coins. By 2021 13% considered themselves ardent hodlers.

KPMG in Canada reported earlier this year that financial services companies would begin widespread adoption of the asset class in 2022. With “almost one-third telling us they have direct or indirect exposure” to cryptocurrency investment already.

With growing interest from personal investors, the financial services sector and the online gambling industry, which was recently regulated in Canada, there is good reason for banks and the government to want to see solid regulation. Change is here, and crypto is leading the charge.